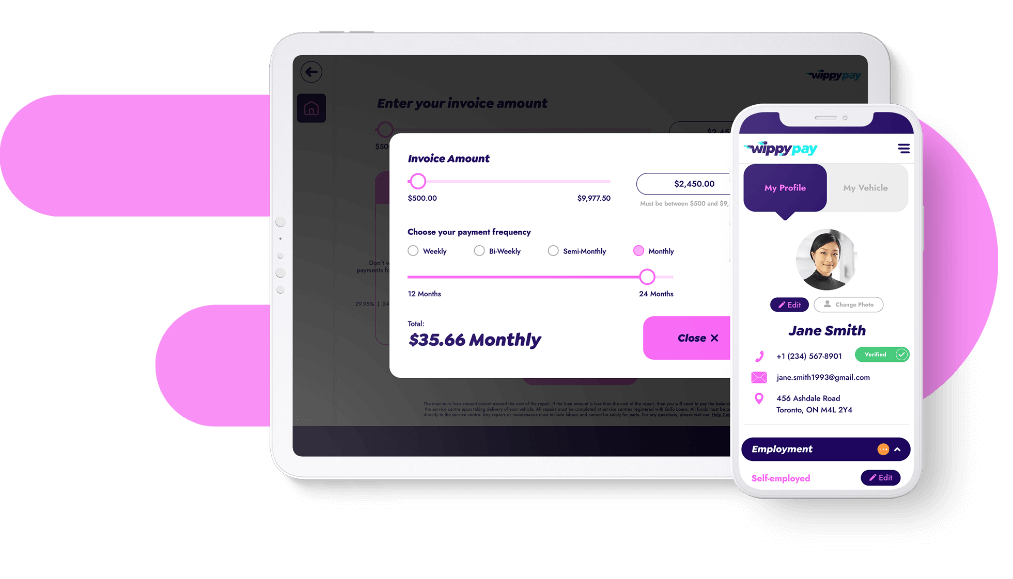

Wippy Pay's Payment Revolution

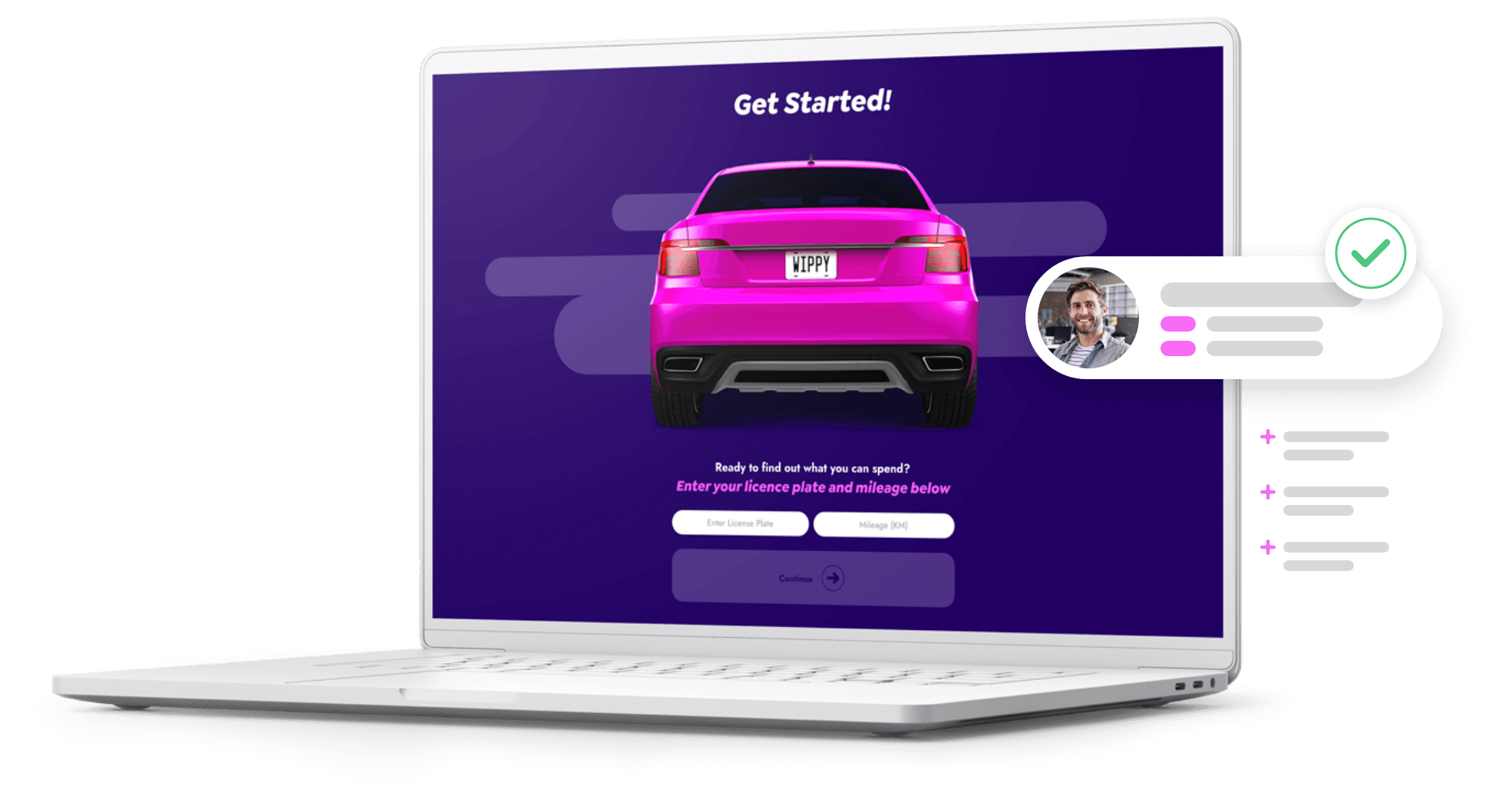

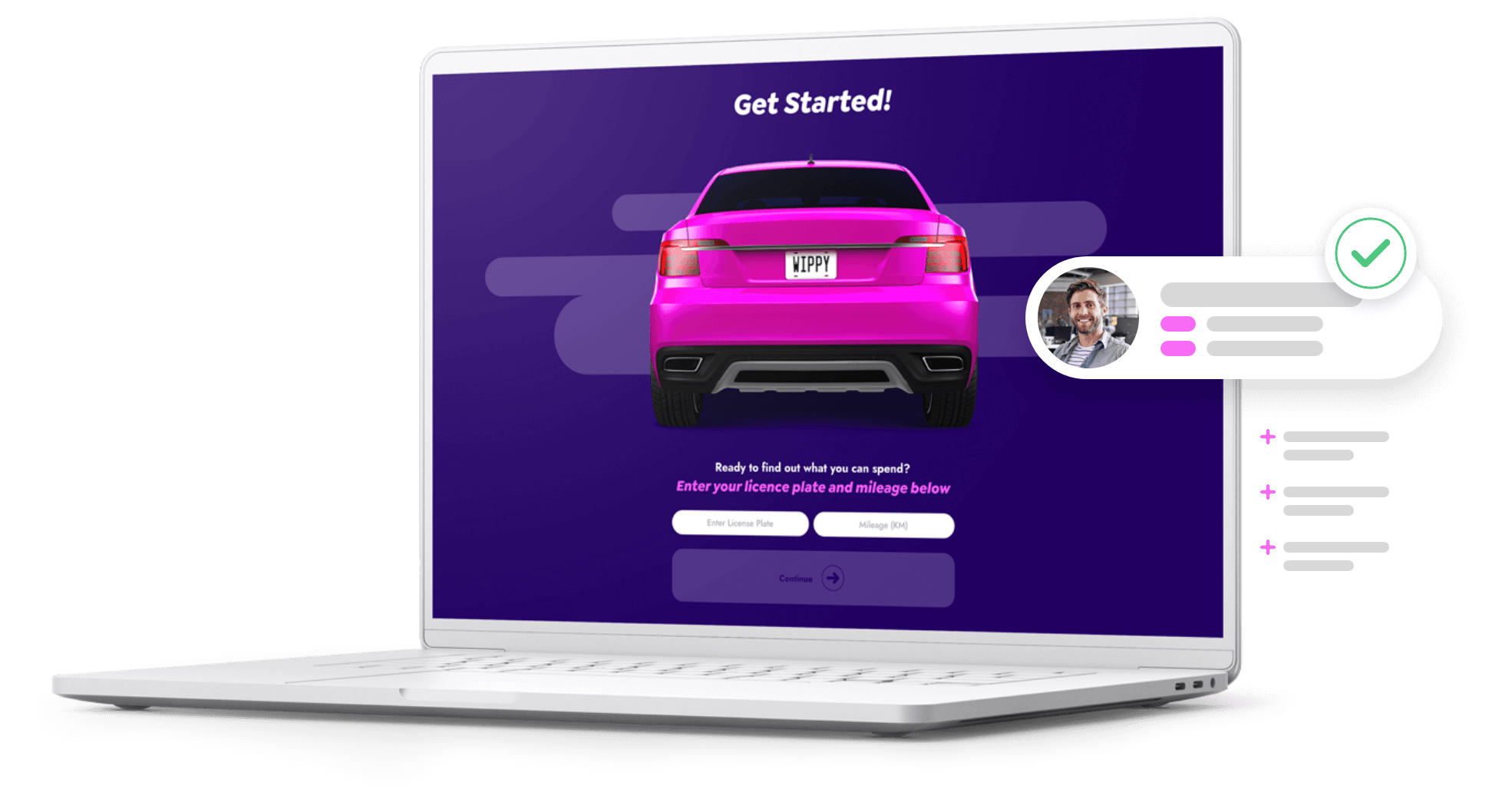

Established in 2018, Wippy Pay has emerged as an industry-leading, cloud-native fintech company, setting the pace with its innovative approach to the Buy Now Pay Later model within the automotive vertical. By diverging from traditional payment methods, Wippy Pay is reshaping how people conduct online and in-store transactions.

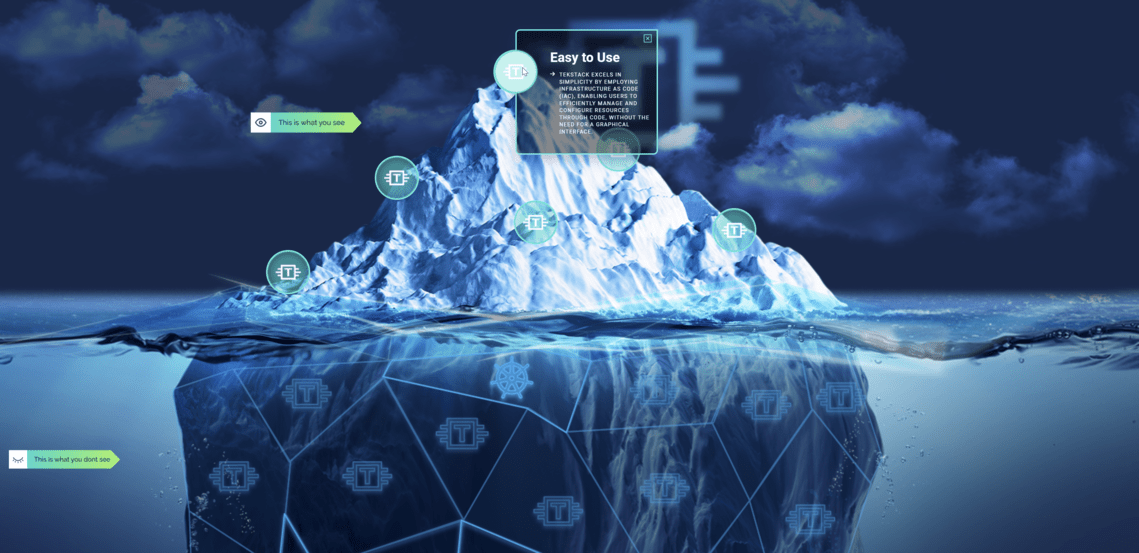

The company’s state-of-the-art platform transforms the payment experience by simplifying and securing every transaction. As a result, Wippy Pay has not only met the demands of the digital era but has also outpaced them, providing an unparalleled payment solution.

For customers, Wippy Pay facilitates a streamlined payment process, adding ease and efficiency that has become synonymous with the company’s name. On the other hand, business owners find in Wippy Pay an opportunity to optimize their operations, unlock new avenues for growth, and boost profitability.

Wippy Pay’s vision is to redefine financial transactions in the automotive industry by leveraging cutting-edge technology and disrupting traditional payment models. The company encapsulates a future-focused mindset, combining robust fintech solutions with a commitment to revolutionize how people pay online and in-store.